- #Pay extraon car loan calc how to#

- #Pay extraon car loan calc plus#

- #Pay extraon car loan calc download#

- #Pay extraon car loan calc free#

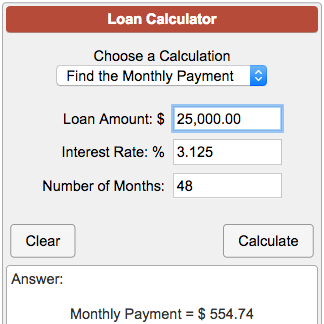

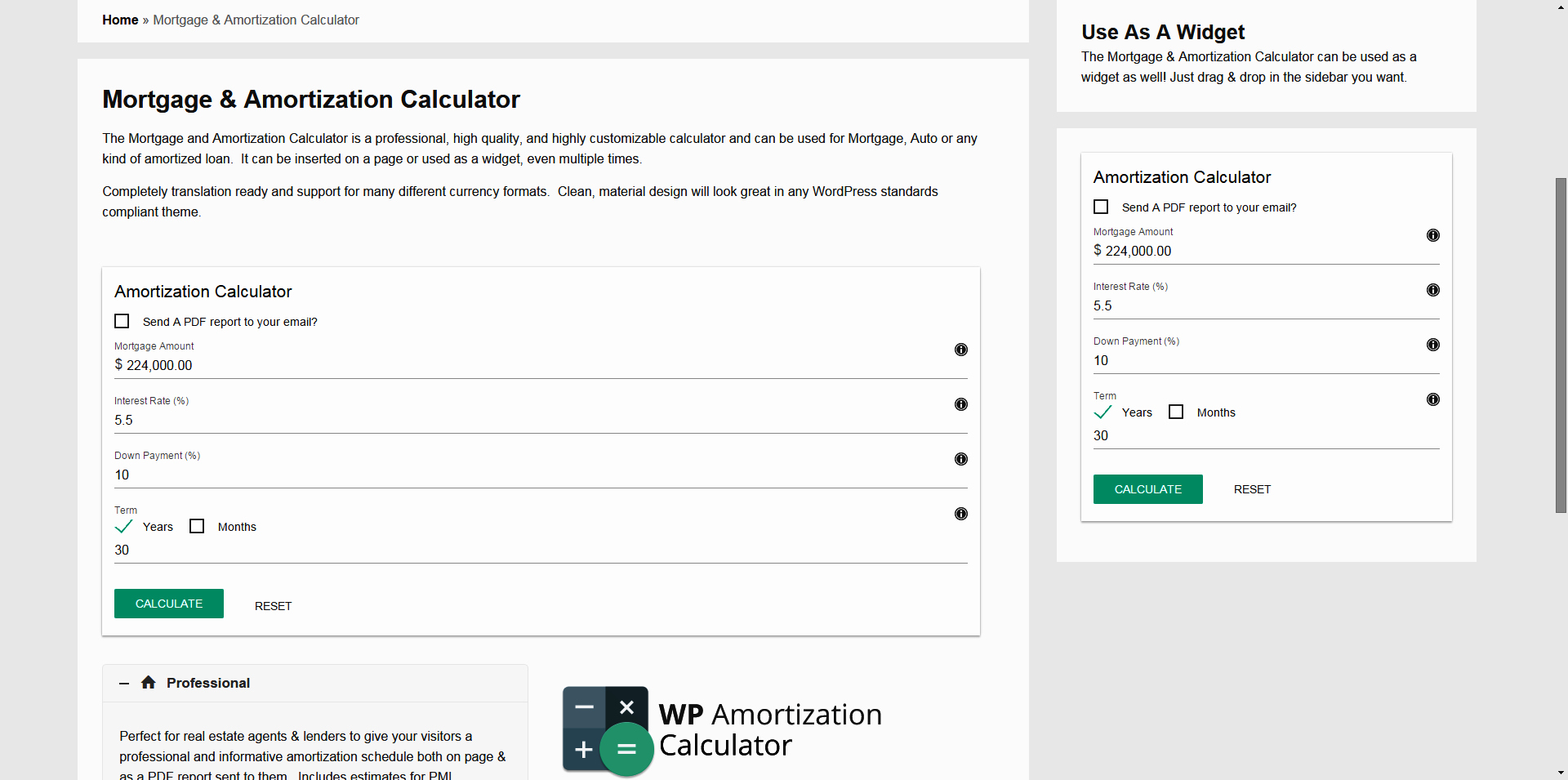

The calculator should only be used as a guide to see how loan repayments can vary when you change the loan amount, interest rate and loan term. Auto Loan Early Payoff Calculator Tech CU. Our calculator features repayment frequency, balloon payments, loan term. This tries to take into account your tax situation and assumes you always itemize (even late into your mortgage when your. Use our car loan calculator to estimate your repayments on a new or used car loan.

This form allows you to compare what would happen if you took one of two choices with a big chunk of cash you have - paying off your mortgage, or investing it instead. Results from the calculators should be used as an indication only, and they do not represent either a quote or pre-qualification or approval for a loan. OriginalOriginalEarly PayoffMonthly PaymentMonthly Payment400.00400.00550.00Expected Payoff TimeExpected Payoff Time31 months31 months23 monthsTotal InterestTotal Interest238.49238.49174.32View 29 more rows (13). Investment versus Loan Payoff - A Scenario Calculator. comparison rate), would equate to a total amount payable of $40,690 (including a $600 establishment fee and $13 monthly loan servicing fees). How often you will be making your payments weekly, fortnightly or monthly. Different terms, fees or other loan amounts might result in a different comparison rate.ĮXAMPLE: A personal loan of $30,000 borrowed for 5 years with an interest rate of 10.99% p.a.

#Pay extraon car loan calc free#

For more information on vehicle sales you can try a number of the free finance tools on our site: Any. Paying off your debt early is also a worthwhile sacrifice as this opens the path to take on other and/or bigger investments. And some of them are as confusing as why you would need scissors to open a package of scissors. Some of the terms on the car payment calculator are simple.

#Pay extraon car loan calc how to#

Show Me the 5 Things How to Use Our Car Payment Calculator Step 1: Plug in your numbers.

#Pay extraon car loan calc download#

Find out what you can spend and how much your repayments will be.WARNING: These comparison rates apply only to the example or examples given and may not include all fees and charges. To pay off any debt early is not impossible but it does necessitate discipline and careful financial planning. Download 5 Things Car Dealers Don’t Want You to Know to find out. Compare car loansĬompare loans before you meet the seller. Otherwise, you could end up needing another loan to pay the lump sum and interest.

#Pay extraon car loan calc plus#

If you choose a balloon payment, you'll need to be able to repay the lump sum plus interest when it falls due. But you'll have to repay the lump sum with interest, so the total cost of the loan is higher. But loans come with monthly (or bi-weekly) payments, and it can be hard to figure out how much youre likely to pay once you factor in things like the loan term. If you do choose to pay off the balance for. This may look like a good deal as your monthly payments will be smaller. To find out how much money you could save in interest, speak with your lender or utilize an auto loan calculator. This option means you pay off part of the loan as regular repayments, and then pay the final amount as a lump sum (this is the balloon payment) at the end of the loan. Some car loans offer a ‘balloon payment’ (also called a residual payment). Planning to renovate,travel or buy a car Know how much you could borrow and what your loan repayments would be with a Peoples Choice Personal loan. Unsecured loans are mainly for used cars. Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. But the interest rate will be higher and you won't be able to borrow as much. View the report to see a complete amortization payment schedule, and how much you can save on your auto loan The American Institute of Certified Public Accountants. With an unsecured loan, you don't have to provide your car as security. If you don't pay the loan back on time, the lender can repossess your car and sell it.

Your car will typically be the security for the loan.

Work out your car loan repayments, and how much you can save by making extra repayments.

0 kommentar(er)

0 kommentar(er)